EQT Eight Bays Global Industry ETF Review

January 2026

Investment landscape for Equities in 2026

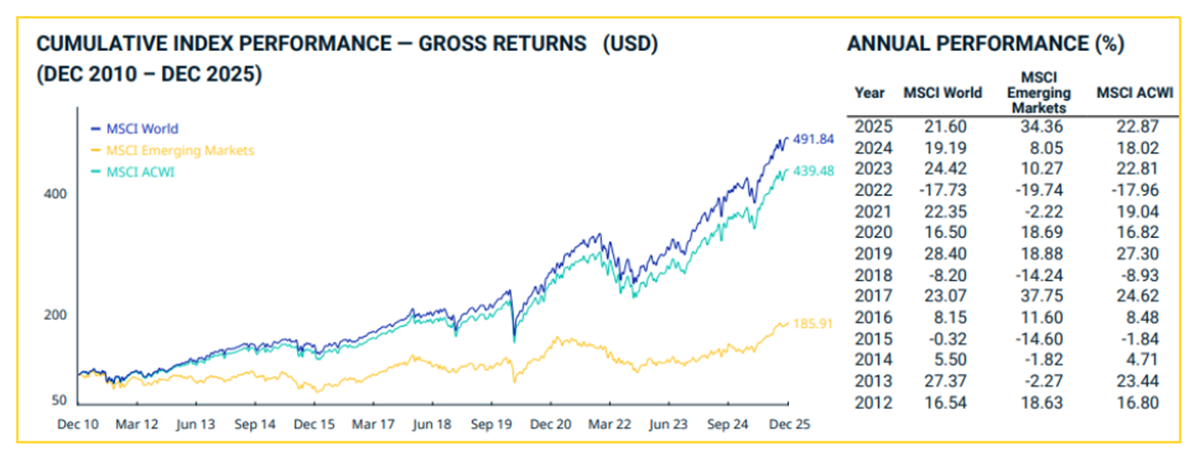

Equity returns over the past three years have been exceptionally strong, with the benchmark MSCI ACWI ETF delivering a 21.7% compound annual growth rate in USD terms during this period. Several factors have underpinned this performance: steady earnings growth, particularly among large-cap technology companies; widespread interest rate cuts by central banks in major economies; moderate global economic growth; fiscal stimulus measures; and a positive investment cycle driven by the deployment of AI infrastructure. Offsetting these positive drivers, however, have been ongoing geopolitical uncertainties and the adoption of trade protectionist policies by the U.S. administration under President Trump.

Three years of solid returns for global equities

Earnings growth

Sectoral earnings continue to benefit from positive structural industry trends, such as increased digitization and AI adoption, especially in technology, healthcare, industrials, utilities, and consumer markets. Technology sector capex is high, driving growth in related industries, with AI-related investments projected to grow over 40% CAGR to $2.7 trillion by 2030. A rebound in commodity prices, particularly base and precious metals, which are currently trading at record levels is also helping to support earnings in the commodity and basic materials sectors. While market consensus expects strong earnings growth in the next two years, actual year-end earnings and revisions always influence stock prices. In 2025, stocks were boosted by a plethora of positive earnings revisions – particularly amongst the large cap tech names. The S&P 500 stocks earnings growth for 2025/2025 was revised up from 7.9% in September to 13.6% today with most sector experience upward revisions.