Equity Trustees Market Outlook October 2025

Report

October 2025

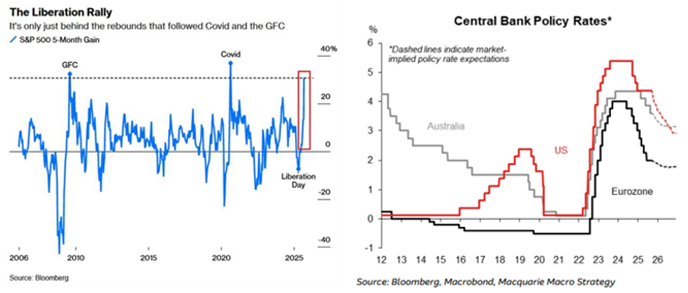

Investment market returns have remained very strong with many equity markets hitting all-time highs. Equity markets have rebounded aggressively from the Liberation Day lows, supported by central bank rate cuts, the AI investment boom, ongoing resilience in global economies, reduced uncertainty around US tariffs and solid corporate earnings. Money supply is increasing while corporate actions (Mergers & acquisitions / IPO’s) have picked up.

MACRO ECONOMIC OUTLOOK

Our key points with respect to current conditions are:

• Global economic growth should remain below trend (~2.5% annualised growth) in the near term due to:

- Slower US growth as tariffs impact US consumption, the housing market remains subdued, the labor market slows and the pull forward of demand (from the 1HCY25) is digested. This is being offset by fiscal initiatives, interest rate cuts, data centre capex spend and the wealth effect of higher equity markets. The capital intensity of technology related spend has large implications on the broader economy. The market appears to be less concerned about any inflation risks.

- While aggregate growth appears reasonable, we think there remains a large and widening divergence within the consumer segment. Spend from higher demographic, asset rich US consumers remain very strong (eg premium airline bookings trends are robust) but many in lower end demographics are struggling (eg trading down occurring, real incomes declining etc).

- Protectionist measures and national security concerns will impact efficient globalisation practices

- European growth remains subdued, albeit there is increased fiscal and infrastructure spend, inflation is under control and interest rates have been cut.

- Chinese growth to gradually slow but be supported by pockets of stimulus. Trade negotiations with the US remain ongoing, which remains a risk given their impact on the global economy and global trade routes.

- The Chinese economy will continue to transition toward a more domestic services and consumer led economy.

Last updated: 6 November 2025