EQT Tax Aware Australian Shares Fund Quarterly Report June 2025

June 2025

Fund Objective

The EQT Tax Aware Australian Equity Fund – Class B (the Fund) aims to deliver gross performance (less fees) above the Benchmark over rolling 3-year periods, after taking into account Fund fees and expenses. The Fund is designed for investors seeking strong medium-to-long-term capital growth potential, coupled with an increasing income stream payable from the dividends of the underlying shares. There is a distinct focus on the after-tax returns offered to investors.

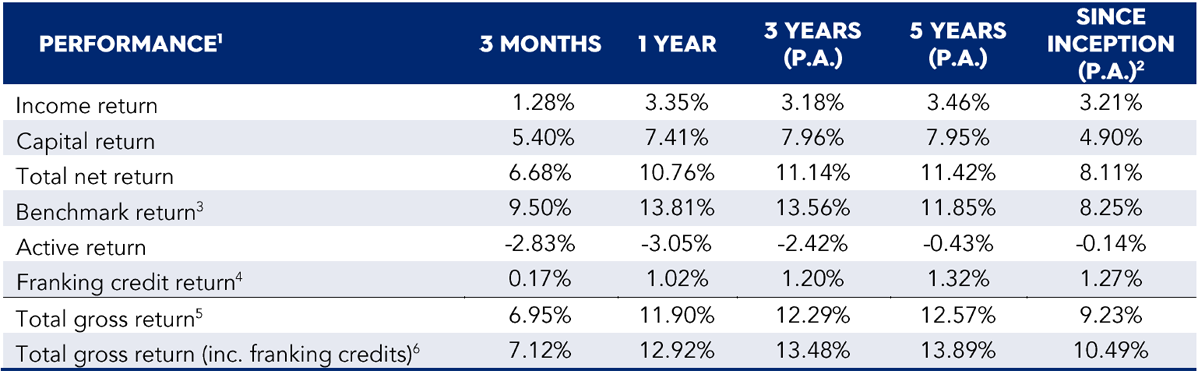

Fund Performance

Table 1 1 Income return and total net return are Fund returns after the deduction of ongoing fees and expense and assumes the reinvestment of all distributions. Results greater than one year are annualised. 2 Inception date is 1 July 2019. 3 Benchmark return is the S&P/ASX 200 Accumulation Index. 4 Franking credit returns are estimates and calculated at a zero-tax rate. However, Investors should seek their own tax advice. 5 Total gross return is fund return before the deduction of ongoing fees and expenses. 6 Calculated as total gross return plus franking credit return. Past performances should not be taken as an indicator of future performance.