EQT Monthly Market Summary July 2025

MARKET SUMMARY

Equities rallied – In local currency terms, the ASX200 (+2.4%) outperformed the US S&P500 (+2.2%), Japan’s Nikkei 225 (+1.4%) and MSCI World ex Australian Index (+0.9%) but underperformed the Chinese equities (+4.5%), UK FTSE 100 (+4.3%) and US Nasdaq (+3.7%) during the month. In $A terms the MSCI World ex-Aust Index rallied 3.1%.

ASX sector performance – Middle East tensions escalated during the month, culminating in the U.S. military launching a series of strikes on Iranian nuclear facilities—a significant escalation in the regional conflict that began with Israel’s surprise airstrikes on Iranian territory on June 13. These developments raised serious concerns about the potential for a broader conflict involving Iran, Israel, and the US. Oil prices initially rose with many concerned that Iran may target the Straits of Hormuz which is responsible for ~20% of global oil trade flows. Despite retaliation from Iran on an US military base in Qatar, tensions simmered over the course of the month. Interestingly, UBS noted that over the last five decades of high-profile geopolitical events, that the Australian equity market has largely dismissed such events and just moved on.

ASX Index drivers – The top five contributors to the ASX index gains were CSL (+50bps), BHP (+42bps), Woodside Energy (+19bps), ANZ (+15bps) and Fortescue (+14bps). The bottom five contributors were Commonwealth Bank (-38bps), Northern Star Resources (-14bps), Macquarie Group (-13bps), National Australia Bank (-5bps) and Evolution Mining (-4.5bps)

US Reporting season strong so far – US Q2 results so far have been solid. ~80% of companies that have reported have beaten market expectations (vs an average of ~76%). IT companies continue to deliver strong results and increasing AI capex. Earnings growth for the quarter is currently ~12% higher (year-on-year). Notably, US companies announced share repurchases totalling $166 billion last month, the highest dollar value on record for July, as buyback plans from the largest American financial and technology companies kicked in.

Bonds sold off – Australian bonds (Bloomberg AusBond Comp 0+Y index) fell 0.04%. Australian 10-year bond yields rose 10 basis points to 4.26%, while US 10-year Bond yields rose 15bps to 4.37%. The value of bonds fall as yields rise.

Australian credit markets rose– Solid domestic economic data and improving consumption trends were supportive for Credit markets. Money supply is increasing aiding credit creation and growth. Demand for higher yielding securities saw Bank Tier2 and corporate hybrids perform strongly over the month. Limited supply of Bank Tier 2 issuance may be lower potentially further compressing spreads. Property and Infrastructure credit exposures remain well bid and an increasing amount of Kangaroo Bonds is enhancing liquidity.

Global economy focused on finalising tariff deals – US economic data was sound. Despite a couple of dissenters the Federal Reserve kept rates unchanged. Trumps stoush with outgoing Federal Reserve Chair Powell continues. The US announced tariff deals with a range of countries which has shifted US tariff rate assumptions higher (toward ~16%). US tariffs imposed so far to date have had a positive contribution to the revenue of the Government. According to U.S. Treasury data U.S. Customs have raised $152b in July, double the $78b netted over the same period last fiscal year. The USD rallied against all major currencies during the month.

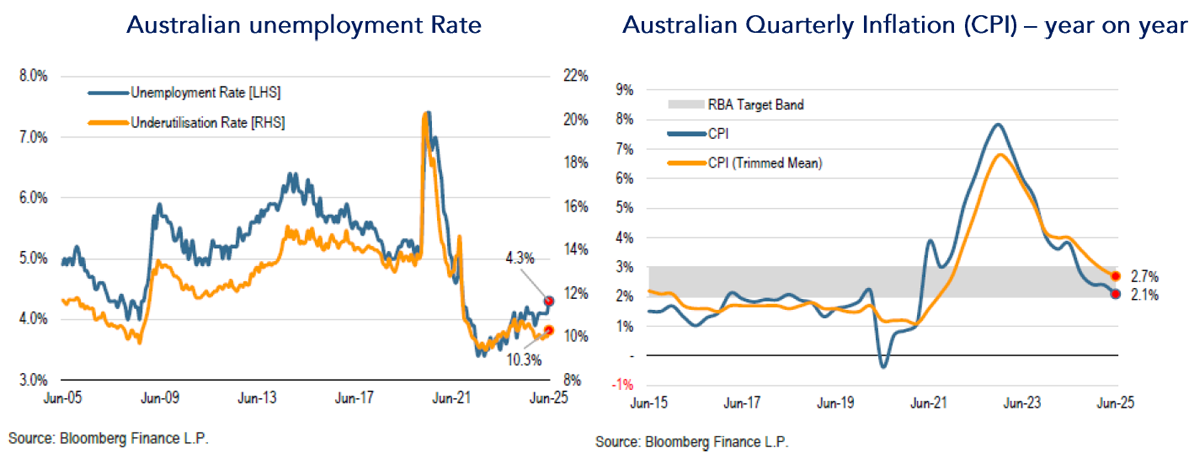

Australian economy prepped for rate cuts – The RBA surprised the market by holding interest rates steady at 3.85%. Economic data was broadly resilient. However, later in the month markets moved to price in a rate cut in August after Australian CPI inflation fell to 2.1% in June (year-on-year) and the unemployment rate rose to 4.3%. Markets are pricing in 2-3 rate cuts in Australia over the next year which is supporting the outlook for household consumption. June retail sales (+1.2% month on month) and credit growth were both strong. Consumer and business sentiment is slowly picking, real income growth is improving, and house prices are rising. The AUD/USD fell 2.4% to 64.25c.

China’s “anti-involution” program impacted commodity prices – – China stimulus talks and the “anti-involution” campaign which is designed to address excessive competition and eliminate outdated capacity (especially in Coal and Lithium) within China impacted commodities. Lithium prices rose 14%. Iron ore and Hard Coking Coal prices rose 6% on strong Chinese steel production. Oil prices rose 6%, precious metals were flat while the LME (base) metals index fell 2.5% (dragged down by Copper -5%). Despite a flat gold price, ASX Gold stocks fell 6.9%.

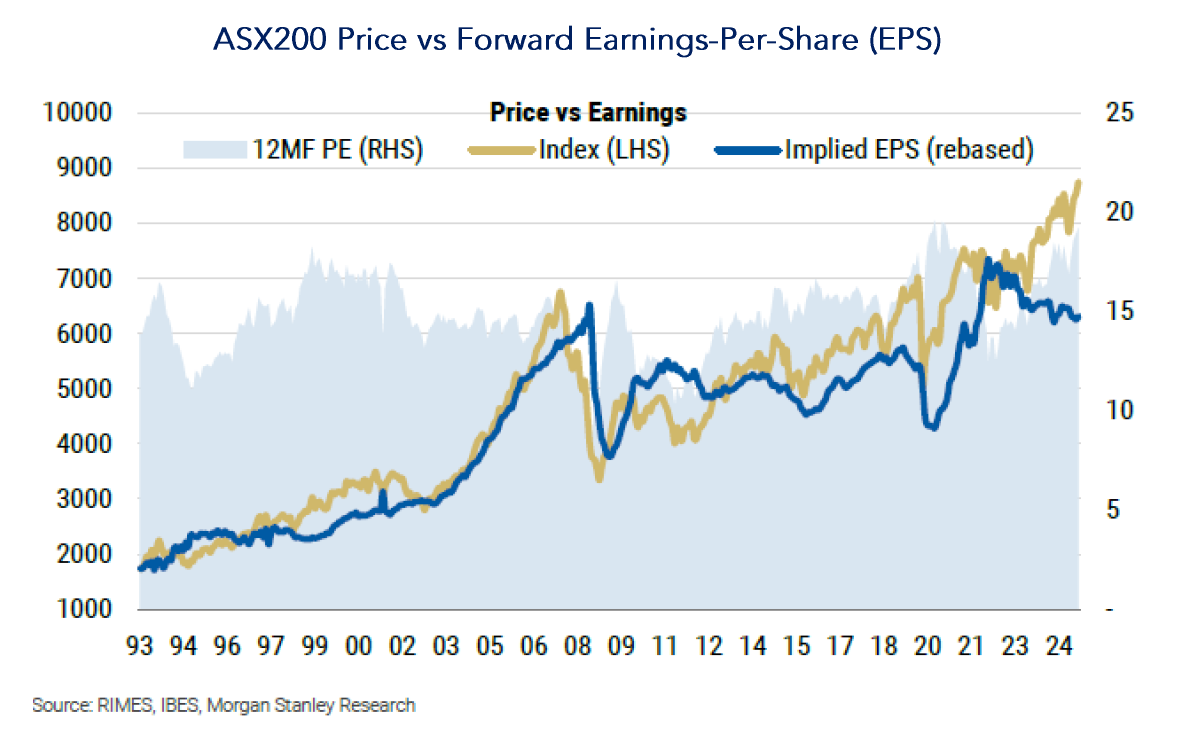

Equity market valuations remain high – Consensus earnings revisions for the ASX200 were revised down again (-1%) dragged down by negative earnings revisions in the Materials and Consumer sectors. Global earnings expectations were steady, but US small caps (+5%) saw the most positive earnings revisions. The ASX200 finished the month trading on ~19.5x 12-month-forward earnings (Price-earnings / PE) which is 20% above the 10-year average. Despite an improving macro-outlook the ASX has already re-rated higher (while earnings have declined). The market expects earnings for the ASX to finish down ~3% in FY25 vs FY24 (the third year of earnings declines). In our view, equity markets remain complacent toward the risks higher tariffs pose on global economic growth.