EQT Eight Bays Global Fund Class B Quarterly Report June 2025

June 2025

Fund Objective

The EQT Eight Bays Global Fund - Class B (The Fund) investment objective is to deliver gross performance (less fees) above the benchmark over rolling 3-year periods.

The Fund is designed to give investors exposure to global growth industries and world leading companies, primarily through a portfolio of US Exchange Traded Funds (ETFs).

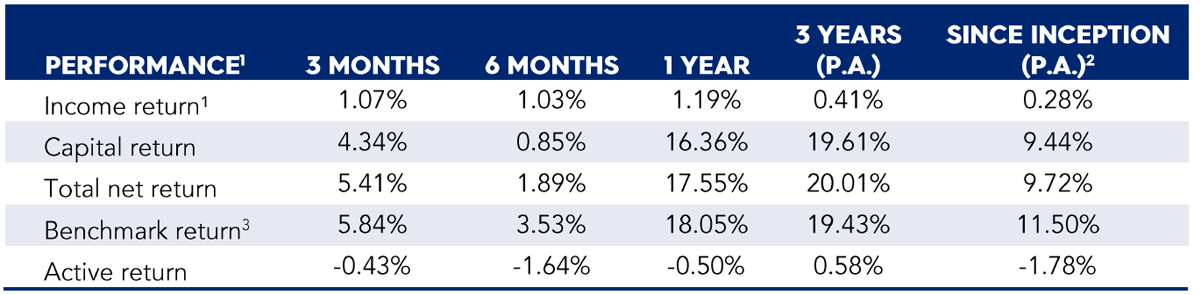

Fund Performance

Over the June quarter the Fund produced a total net return of 5.41% underperforming the benchmark by 0.43%. Over the last 12 months the Fund has delivered a total net return of 17.55% underperforming the benchmark by 0.50%.

Over the last 3 years the Fund has delivered a very strong total net return of 20.01% pa outperforming the benchmark by 0.58%. Since inception (1/7/21) the Fund has delivered a total net return of 9.72% per annum.

Table 1

1 Performance: Income and total net returns are fund returns after the deduction of ongoing fees and expenses and assumes the reinvestment of all distributions. Results greater than one year are annualised.

2 Inception date is 1 July 2021.

3 Benchmark return is the MSCI ACWI ex Australia net return Index (AUD).

Past performance is not an indicator of future performance.