Equity Trustees Market Outlook FY26

July 2025

FY25 investment market returns were strong across a wide range of asset classes. In the first half of FY25 returns were assisted by lower inflation, expectations of interest rate cuts, resilient economic data and global technology sector earnings growth and investment. The second half of FY25 was more volatile impacted by slowing economic growth, US tariff concerns and geopolitical conflicts. Despite these events, the June half still finished strongly, as trade tensions diminished, global economic growth remained resilient, central banks moved to lower interest rates and US tech companies reinforced their strong growth outlook. Notably, the equity market rebound from the post “Liberation Day” lows was swift and powerful.

MACRO ECONOMIC OUTLOOK

Our key points with respect to current conditions are:

Global economic growth is likely to slow in the 2H of CY25

- Global economic growth has benefited from a pull forward in demand prior to the enactment of US tariffs. This likely means the second half of 2025 will likely see economic growth slow.

- Despite pauses put in place, the US Tariff environment remains uncertain and inevitably we think there will be tariffs enacted that will act as a drag on global economic growth.

- While deals will ultimately be negotiated, we think markets are already pricing in an environment where global growth is not disrupted in any major way.

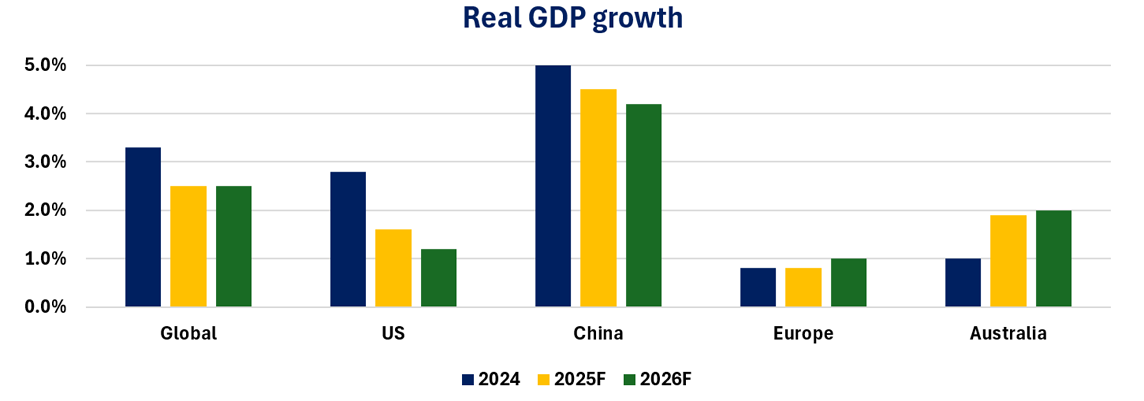

Global economic growth remains below trend but is unlikely to fall into recession.

- Global growth is likely to slow to ~2.5% in FY26. Offsets to the tariff drag include lower interest rates and fiscal spending. At the time of writing, markets were pricing in ~85bps of US Fed easing for FY26 and another 25bp rate cut by the European Central Bank. Broadly global inflation is back within targeted bands, and the services sector has become an increasing driver of economic growth in the US with lower volatility than the goods sector.