EQT Monthly Market Summary June 2025

MARKET SUMMARY

Equities continued their recent rally as uncertainty eased, and Tech reasserted itself – Easing trade concerns, central bank rate cuts and more positive US earnings revisions offset geopolitical tensions. Tech stocks reasserted themselves and drove equity markets higher. In local currencies, Global equities (ex-Aust) rallied 4.8% driven by the US S&P500 (+5.1%), Japanese Nikkei (+6.6%) and Asia-Pacific ex Japan (+5.8%). The ASX200 rose 1.4% while European markets (-1.1%) relatively underperformed. In $A terms the MSCI World ex-Aust Index rallied 2.5%.

Middle Eastern tensions rose but then simmered – Middle East tensions escalated during the month, culminating in the U.S. military launching a series of strikes on Iranian nuclear facilities—a significant escalation in the regional conflict that began with Israel’s surprise airstrikes on Iranian territory on June 13. These developments raised serious concerns about the potential for a broader conflict involving Iran, Israel, and the US. Oil prices initially rose with many concerned that Iran may target the Straits of Hormuz which is responsible for ~20% of global oil trade flows. Despite retaliation from Iran on an US military base in Qatar, tensions simmered over the course of the month. Interestingly, UBS noted that over the last five decades of high-profile geopolitical events, that the Australian equity market has largely dismissed such events and just moved on.

ASX sector performance – The best performing ASX sectors for the month were Energy (+9.0%), Financials ex property (+4.3%) and Property/AREITs (+1.8%). Higher oil prices and M&A activity buoyed the Energy sector. The worst performers were Materials (-3.1%), Consumer Staples (-2.3%) and Healthcare (-1.0%). The top five contributors to the ASX index gains were the major banks, Macquarie Group and Santos. CBA continued to defy many fundamental analysts’ views hitting a record high during the month while Santos surged on the back of a takeover bid. In other M&A activity, Washington H. Soul Pattinson and Brickworks intend to merge while Xero announced the acquisition of US payments business Melio Limited. The bottom five contributors were the large iron ore (BHP and RIO) and gold producers (Northern Star Resources & Evolution Mining). Globally, IT, Communication Services and Energy performed best.

Bonds rallied – Australian bonds (Bloomberg AusBond Comp 0+Y index) rose 0.75%. Australian 10-year bond yields fell 10 basis points to 4.16%, while US 10-year Bond yields fell 17bps to 4.23%. The value of bonds rise as yields fall. Lower bond yields also helped interest rate sensitives such as the AREITs (property stocks).

Australian credit remained well bid – As the month wore on sentiment turned more positive compressing spreads. Credit supply rebounded and this was reflected in the improving sentiment towards new issues, which saw a reasonable bid tone. Lower expected interest rates have led to a rebound credit growth domestically. Supportive economic activity is good news for credit fundamentals. A note of caution though is what happens next post July 4 (Trump’s tariff deadline) with no major trade deals settled.

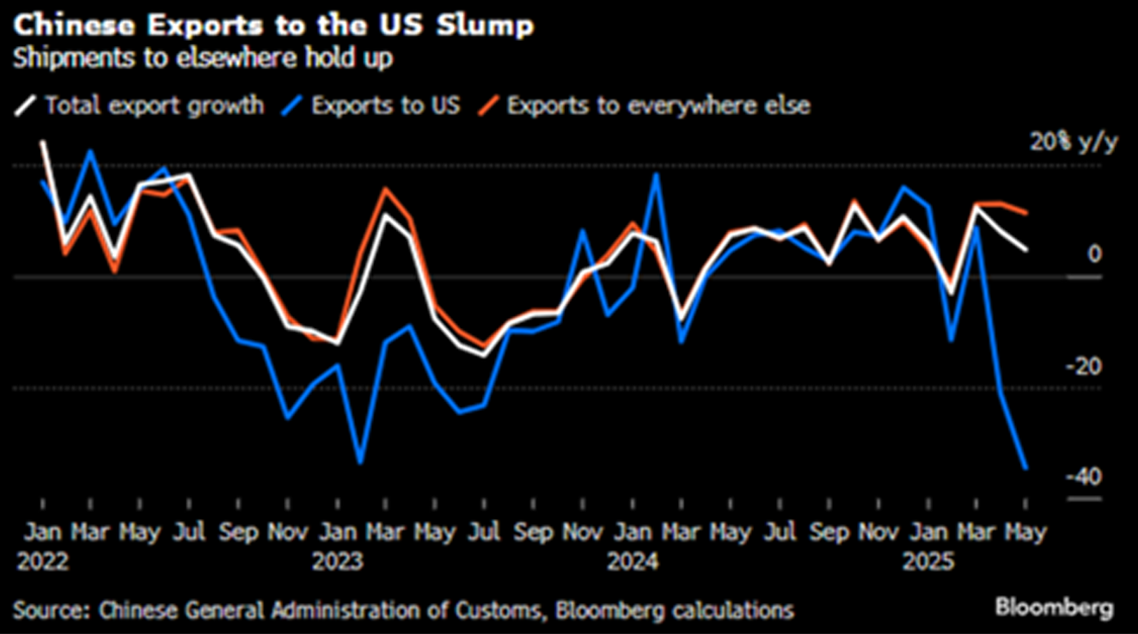

Global economy stubbornly resilient – Trade flows have started to reorganise themselves. Investor focus has moved from tariff headwinds to potential tailwinds via tax cuts from the “One Big Beautiful Bill”. The US central bank kept rates unchanged at 4.25-4.5%. Inflation currently appears in check. Some Federal Reserve officials said they were ‘open’ to cutting rates. A Morgan Stanley survey noted that consumer sentiment in the US toward the economy and household finances has stabilised, but (tariff related) inflation remains the primary concern. Activity in the US housing market remains weak. The USD continued its fall. Inflation in Germany and Italy surprised to the downside. The Swiss, Norwegian and Swedish Central Banks cut rates. Sino-US relations stabilised as the quarter progressed as trade talks developed and tariff rates fell. In China, while housing remains weak, broad economic data seems reasonable. Expectations for increased policy stimulus were lowered. China’s exports to the US have slumped but held up elsewhere (see chart below).

Australian economy – Economic growth generally disappointed, inflation continued to track lower, and the labour market remained tight. The Fair Work Commission delivered a 3.5% wage rise for minimum and award wage reliant workers. FY26 state budgets noted intentions to improve fiscal positions via capex constraints. The market expects the RBA to cut another ~3 times this year which should support growth as the year progresses. The AUD/USD rose a another 2.3% to 65.81c.

Commodities broadly rose – Oil (WTI) surged 9% over the month (to US $65/bbl) on the back of conflicts within the Middle East. However, OPEC is considering extending its production increases next month which may cap further gains. Base metals (LME Index) rose another 4.8% while gold nudged higher (0.4%) to US$3303/oz. Iron ore prices fell (-3% to US$94/2/t) for the fifth consecutive month. Lithium prices rose 4% halting recent declines but are still down 38% over the last year. US tariffs and China’s steel policy remain the key focus for investors.

ASX200 earnings & valuation – Consensus earnings revisions for the ASX200 were marginally revised down (again) 0.4%, dragged down by negative earnings revisions in the Utilities, Energy and Consumer discretionary sectors. Conversely, earnings in the US have started to be revised up. Post the spectacular recovery since the mid-April lows, the ASX200 trades expensively ending the month trading on 19.0x 12-month-forward earnings (Price-earnings / PE) challenging the equity market outlook into FY26. US and Global Equity PE multiples are also approaching highs also (see chart below).