EQT Monthly Market Summary May 2025

MARKET SUMMARY

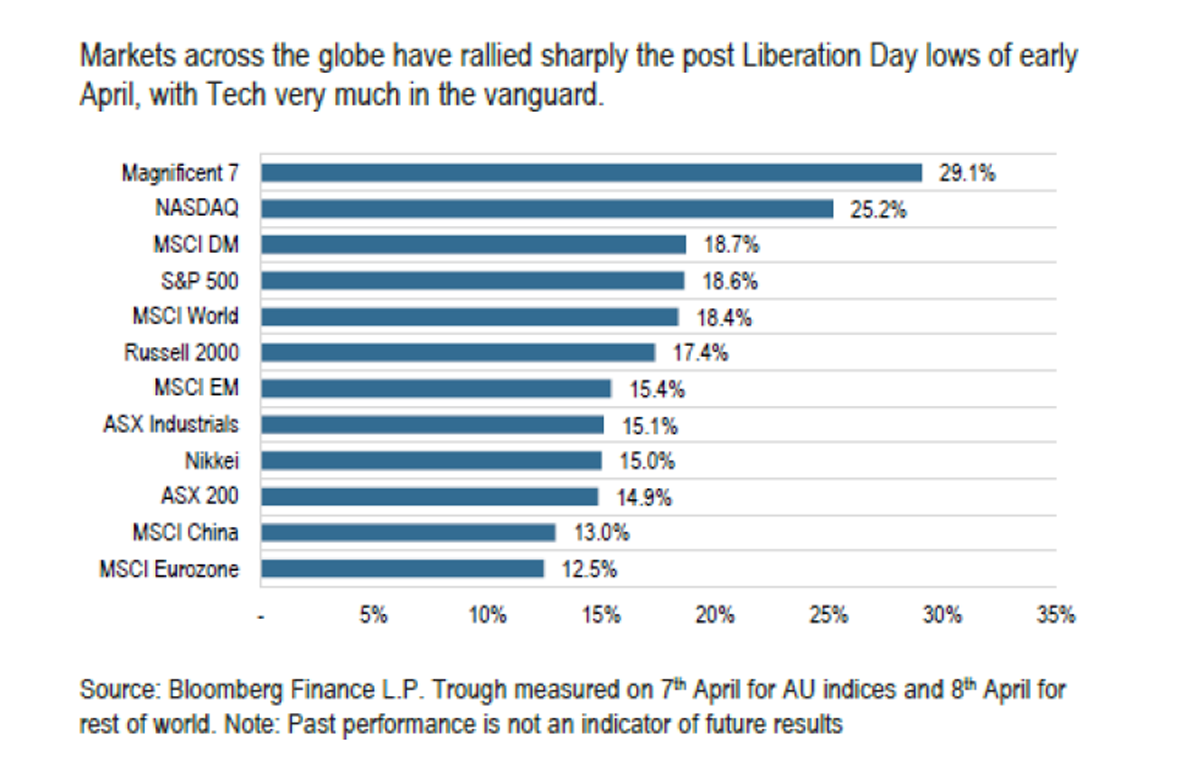

Equities rallied strongly as trade and tariff tensions eased – The risk-on trade following Trumps tariff pause in April continued in May. Global equities had its best month since November 2023. In local currency terms, the ASX200 rose 4.2%, the US S&P500 jumped 6.2%, Europe rebounded 5.4% and the Japanese Nikkei 225 rallied 5.3%. Tech stocks bounced back strongly. The US Nasdaq was one of the strongest markets rising 9.6%. In $A terms the MSCI World ex-Aust Index rallied 5.34%. Australian small caps outperformed. The chart below (from JPMorgan) shows the bounce since the Post Liberation Day lows.

US tariffs remain the key focus – During the month, tariff rates on China were lowered, EU tariff rates were lifted to 50% and reversed to back to 10%, and the tariffs were declared illegal by the US court of international trade, before that decision was reversed in a court of appeal. In addition, the Trump administration announced the “One Big Beautiful Bill” encompassing tax reform. Despite the encouraging directional moves there remains considerable uncertainty about where tariffs will land which is likely to weigh on corporate investment and near term global economic growth.

ASX sector performance – The best performing ASX sectors for the month were Information Technology (+19.8%), Energy (+8.6%) and Communication Services (+5.5%). The worst performers were the low beta defensives sectors Utilities (+0.3%), Consumer Staples (+1.2%) and Healthcare (+1.6%). The top five contributors to the ASX index gains were Commonwealth Bank of Australia (+52.1bps), Macquarie Group (+24.5bps), Goodman Group (+19.9bps), National Australia Bank (+19.1bps) and Wesfarmers (+17.8bps). Conversely, Aristocrat Leisure, ANZ, CSL and Rio Tinto dragged on the index. The continued rise of Commonwealth Bank (CBA), despite its stratospheric valuation, has hurt the relative performance of most active managers. Globally, IT, Communication Services and Industrials performed best

Bond yields rose as growth concerns lessened – Australian bonds (Bloomberg AusBond Comp 0+Y index) rose marginally (+0.16%). 10-year bond yields rose in all major markets. Australian 10-year bond yields rose 9 basis points to 4.26%. US 10-year Bond yields rose 24bps to 4.4%. The value of bonds fall as yields rise

Australian credit rallied – Over the month of May credit markets breathed a sigh of relief as Trump delayed his imposition of tariffs. Investor demand for credit increased tightening spreads. Over the course of the month several new issues were launched with strong demand shown. Overall the economy is being supported by reasonable credit growth up 8%, lower interest rates and a nominal increase in capex, suggesting a supportive environment for credit.

Global economy – Globally manufacturing data has stabilised while services have weakened. The US Federal Reserve held rates steady at 4.5%. Inflation fell to 2.3% year-on-year, but near-term inflation expectations lifted. The US 30-year bond yield rose to 4.92%, a 50bp spread over the 10-year signalling concern over future inflation and the sustainability of the US fiscal position. While future indicators are soft, economic data releases have remained reasonable. The USD continued its fall indicating distrust of the US administration. In China, retail sales, consumer confidence and housing related data remain soft, while manufacturing activity remained robust. Chinese exports to the US have fallen but have increased elsewhere.

Australian economy – Labor won the election. The RBA cut rates 0.25% to 3.85% with a dovish tone citing economic risks to the global economy and well-behaved domestic inflation (April CPI 2.4% year-on-year). Economic momentum has faded recently. Retail trade disappointed but the unemployment rate remained unchanged at 4.1%. The market is forecasting ~3 rate cuts by year end. The AUD/USD rose a further 0.5% to 64.31c.

Commodities mostly rebounded – Base metals (LME Index), Oil and Natural gas rose 2.7%, 4.4% and 3.6% respectively. Gold finished flat and iron ore dropped 1%. Lithium (Spodumene) continued to fall dropping 19%.

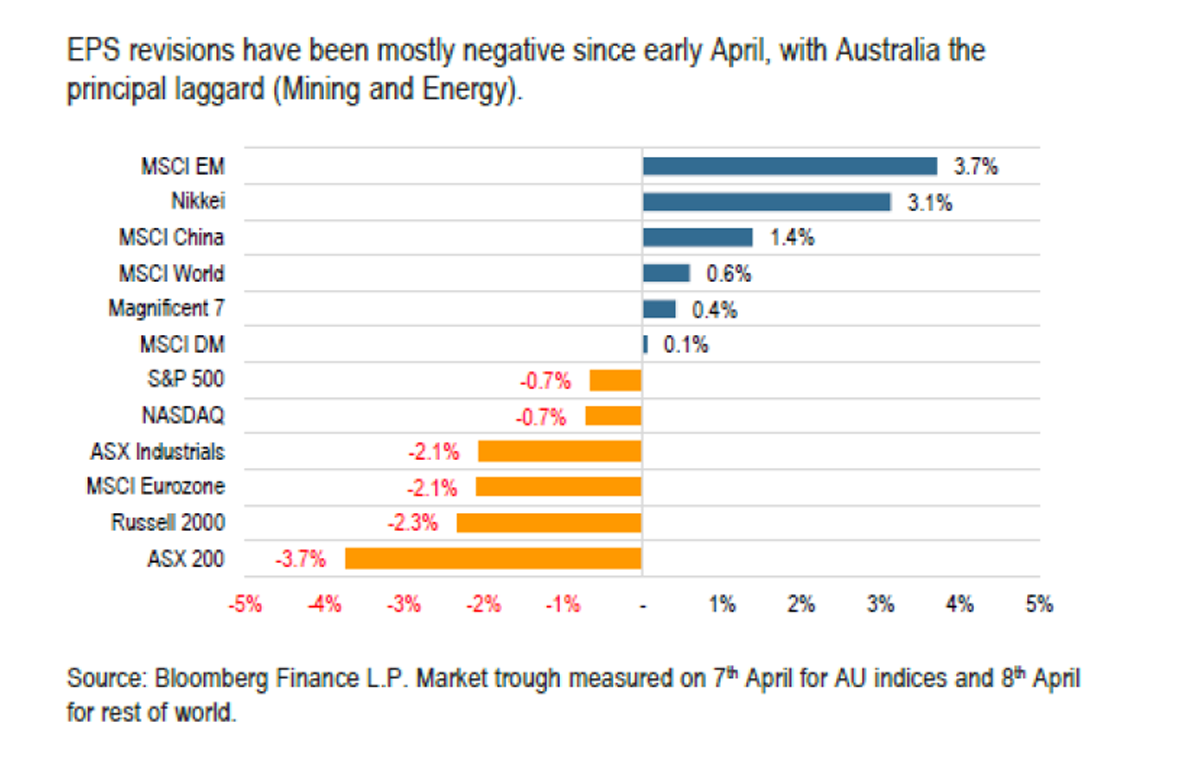

ASX200 earnings & valuations – Despite index gains, consensus earnings revisions for the ASX200 were revised down 1.1%, dragged down by negative earnings revisions in the Energy, Consumer discretionary and IT sectors. The index re-rated higher over the month by 1.6 PE points. The ASX200 remains in expensive territory ending the month trading on 18.8x 12-month-forward earnings (Price-earnings / PE) which is a 24% premium to the 15-year average of 15x. Consensus forecasts are for ~5.6% earnings growth in FY26. The ASX dividend yield has declined to 3.4% well below historical levels of 4.5% and the Australian 10-year bond yield of 4.3%. As noted by JPMorgan below, recently global market earnings have remained broadly unchanged at an overall level with Emerging markets and Japan experiencing positive revisions and US and Europe seeing negative revisions.