EQT Monthly Market Summary April 2025

MARKET SUMMARY

April was a rollercoaster ride – While global equity markets finished broadly flat over the month it was anything but a boring period. The month was marked by significant volatility in global investment markets, primarily driven by the U.S. administration's aggressive trade policies. Markets sank on the back of US President Trumps ‘Liberation Day’ announcements which introduced broad-based and higher than expected tariffs but rallied later in the month after he announced a 90 day pause (ex-China) and news of trade negotiations emerged. The tariff announcements have created considerable uncertainty and reduced confidence in US policy and assets. In response to the turbulent environment, investors began reallocating funds towards lower-risk options such as government bonds and gold and switched out of US equities into other regions. Continued uncertainty is likely to continue to weigh on business and consumer confidence.

Australian Equities outperformed – In local currency terms, the ASX200 (+3.6%) outperformed global equities (MSCI World ex-Aust +0.58%). In $A terms the MSCI World ex-Aust Index dropped 1.84%. The ASX200 performance was particularly impressive against the US S&P500 which fell 0.7% during the month (in USD terms). Large cap stocks outperformed small caps in Australia. Offshore investors sought the ‘relative’ safety of the Aussie equity market during the month.

Sector performance – All ASX sectors ended the month higher except Energy. The outperformance of banks relative to Resources continued. The strongest performing sectors in the ASX200 were Communication Services (+6.5%), Information Technology (+6.4%) and Property/AREITs (+6.3%). The worst performers were Energy (-7.7%), Materials (+0.7%) and Utilities (+1.9%). Taking market capitalisation into account, the major banks, Wesfarmers and Telstra positively contributed to the ASX200 gains, while large energy companies, South32 and Macquarie Group weighed. Globally, Utilities and Consumer Staples fared best while Energy and Healthcare lagged.

Bond safety sought – Australian bonds (Bloomberg AusBond Comp 0+Y index) rose 1.7% as investors sought safety. 10-year bond yields fell in most major markets. Australian 10-year bond yields fell 22 basis points to 4.16%. US 10-year Bond yields fell 4bps to 4.16%. The value of bonds rise as yields fall.

Australian credit spreads widened – Australian Credit (ex MBS) markets rose 1.09%. Post the Liberation Day announcements risk-on moved rapidly to risk-off. The net result was a significant movement in credit spreads across the board. Credit widened considerably before slowly compressing as the month ended.

US economic growth fears increased – The U.S. reported a 0.3% contraction in GDP for the first quarter of 2025. This downturn was largely attributed to businesses accelerating imports ahead of the tariff implementation. Payrolls remain solid, but US consumer confidence dropped and economists downgraded US GDP growth forecasts. Inflationary pressures also persisted, with core inflation rising to 2.6%, surpassing the Federal Reserve's target. These factors contributed to heightened market volatility, with investors grappling with the implications of a potential stagflation scenario. The USD fell as global investors lost confidence in US assets and defensive currencies such as the Swiss Franc and Japanese Yen were bought. China’s economic data softened led by weaker manufacturing data.

US Reporting Season has been reasonable so far – As at the end of April, Q1 US reporting season was part way through. About 60% of companies have reported in the US with 77% have beating expectations while in Europe 55% of companies have surpassed analyst forecasts.

Australian economy – The RBA left policy unchanged in April but noted rising risks around global growth. Mark quarter core inflation fell back into the RBA band (2.9% year-on-year), but the labour market remains tight. Markets are pricing in a high chance of a rate cut by the RBA in May and further rates cuts over the year. Retail trade and consumer confidence softened. In early May the Labor party was re-elected. More government spending is likely. National housing prices rose back to all-time highs in April (0.2%M, 2.6%Y) supported by the outlook for rate cuts and government support. The AUD/USD rose 2.5% to 64.02c.

Ex-Gold Commodities fell as global growth concerns weighed – Gold rose another 5.3% to US$3288/oz and is now 44% higher than a year ago. Otherwise, base metals (LME Index) fell 6.3%, iron ore dropped 5% to $99.50/, Lithium (Spodumene) prices fell 10% and oil (WTI) sank 18.6% to close at US$58.2/bbl.

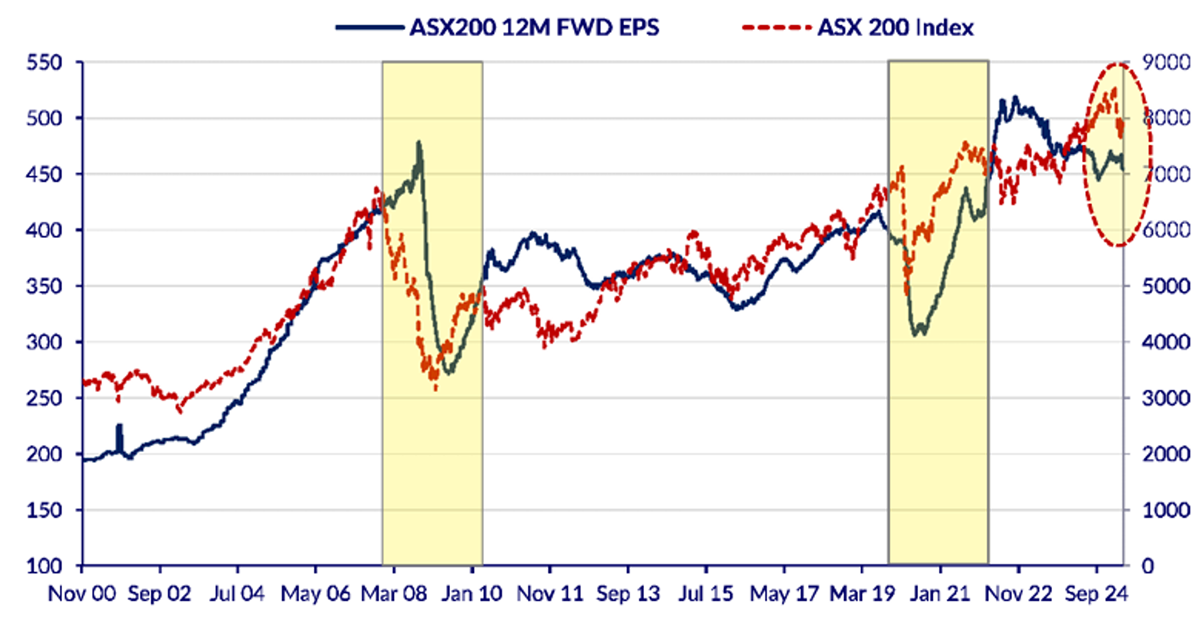

ASX200 earnings at risk – Consensus earnings revisions for the ASX200 were revised down 1.3% mainly because of downgrades in the Energy sector (-15.3%). Consensus is still expecting 6.2% earnings per share (EPS) growth in FY26 (vs FY25). The chart below shows that last year the ASX200 index gapped up above the 12-month forward (12M FWD) EPS. The market typically follows earnings. If we continue to see further earnings downgrades the market is likely to fall further. While the direct impact of tariffs for Australia is less than many other nations, the indirect impact of weaker trading partners remains the key risk, however rate cuts and ongoing fiscal spending are supportive offsets.

Source: CLSA, Refinitiv

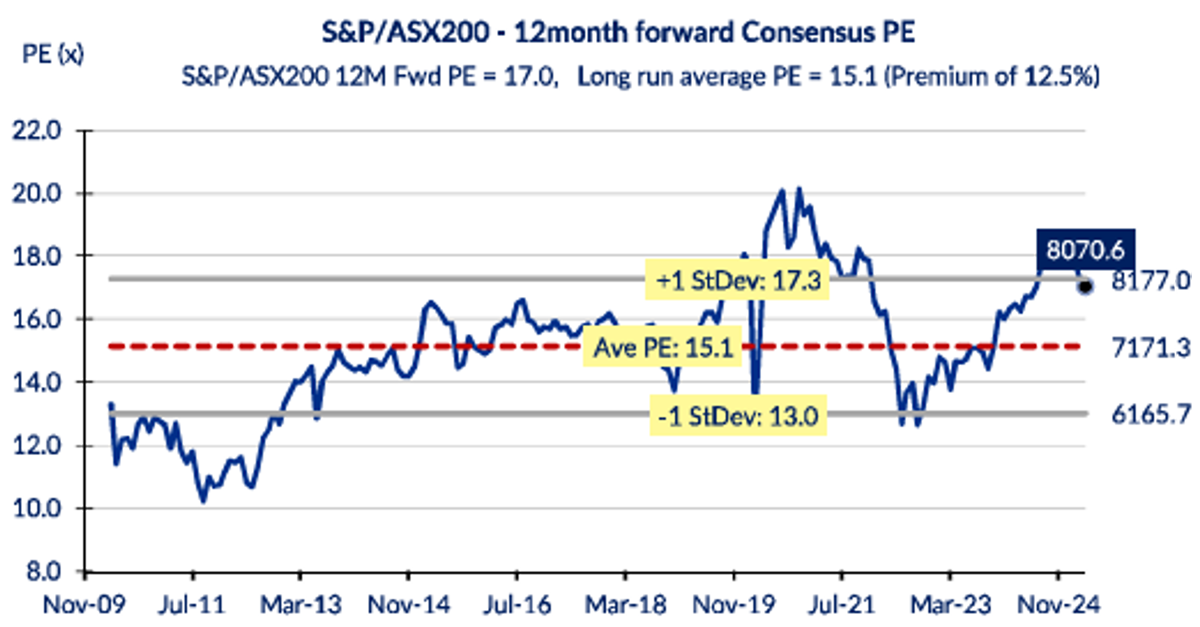

ASX200 valuations – The ASX200 is currently trading at 17x Price-earnings (PE) ratio which is still expensive versus long-term average levels of 15.1x. Not only do we think that earnings may still be at risk in the short term, but the market is not fully pricing in that risk. Therefore, from a tactical asset allocation perspective, we remain underweight equities.

Source: CLSA, Refinitiv