News and Insights

GemLife has partnered with Equity Trustees as the Responsible Entity and Custodian for the GemLife Communities Group Fund (ASX:GLF), which launched via initial public offering (IPO). The demand for the IPO exceeded the initial target of $750 million. This was also the first fund to successfully list under ASIC’s fast-track IPO process, which aims to improve market efficiency while maintaining strong investor protections.

Report

Get the latest market updates and insights with, Investment Specialist, Grant Mundell's monthly market summary.

The power of 28 philanthropic trusts managed by Equity Trustees has been combined to grant more than $7 million over five years to support the work of three of Australia’s leading medical research organisations.

Article

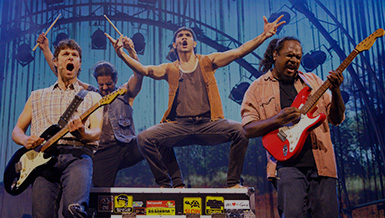

Theatre has the power to change the lives of audiences, but Ilbijerri Theatre Company does more – it also empowers the lives of its storytellers.

Article

The successful art and dementia programs run by the Museum of Contemporary Art Australia remind us that, despite great change and loss, creativity ignites connection.

Article

Every winter, the Melbourne International Film Festival screens groundbreaking films that create transformational change among diverse audiences. Here’s why the cultural institution needs to be financially protected, now more than ever.

Article

Adults with an intellectual disability and natural artistic talent have been supported to shine at an inclusive arts centre in Melbourne.

Article

Food, performance and storytelling have been blended together to create Dining Room Tales, a unique style of social art practice that takes place in people’s homes. Here’s how the art form is impacting audiences and strengthening communities.

In accordance with ASX Listing Rule 12.10, EQT Holdings Limited (ASX: EQT) (the Company) advises that it has amended its Securities Trading Policy with effect from 19 June 2025.

EQT Holdings Limited (ASX: EQT) today announced that Non-Executive Director, Glenn Sedgwick, will retire as a director of the Company at the upcoming Annual General Meeting, scheduled for 30 October 2025.

Report

The markets since April have moved with an interesting trajectory. Equity markets continue to rally despite uncertainty and possible stalling of the bond rally in the U.S.